Introduction

Welcome to this article dedicated to swing trading, an accessible and flexible trading method suitable for both beginners and more experienced traders. If you are looking to diversify your income or achieve financial independence, swing trading can be an excellent option for you. Together, we will explore the principles of swing trading, its advantages, specific strategies to apply, and how you can confidently get started.

What is Swing Trading?

Swing trading is a trading strategy that involves holding positions for a longer period, typically from a few days to a few weeks. Unlike day trading, where positions are opened and closed within the same day, swing trading allows for a more relaxed and less stressful time management.

In this method, the goal is to take advantage of the natural fluctuations of the markets without being glued to the screens all day. This makes swing trading an ideal option for those who have other commitments, such as a full-time job or a business to manage.

Why Choose Swing Trading?

Time Flexibility: Swing trading does not require you to constantly be in front of the screen, allowing you to manage your schedule as you see fit. You can analyze the markets at your own pace, set alerts, and wait for the right moment to act.

Less Stress: Unlike scalping or day trading, swing trading gives you time to think about your decisions. You are not forced to make quick decisions, thus reducing the risk of errors due to stress.

Favorable Time-to-Profit Ratio: By spending less time per week trading, you can achieve results comparable to those of day traders, but with significantly less time investment.

Specific Strategies for Beginners in Swing Trading

1. Using Moving Averages

Moving averages (MA) are among the simplest and most effective tools for identifying market trends. They help smooth out short-term fluctuations and detect long-term trends.

Simple Moving Average (SMA): This is calculated by taking the average of closing prices over a given period. For example, the 50-day SMA is a good indicator of medium-term trends.

Exponential Moving Average (EMA): More sensitive to recent price changes, the 20-day EMA is ideal for swing trading as it quickly reacts to trend changes.

2. Moving Average Crossover Strategy

A popular strategy is to follow the crossover of two moving averages :

- Bullish Crossover: When the 50-day SMA crosses above the 200-day SMA, it signals an upward trend.

- Bearish Crossover: When the 50-day SMA crosses below the 200-day SMA, it indicates a downward trend.

This method is very useful for spotting entry and exit points in the market.

3. Support and Resistance Strategy

Supports and resistances are price levels where the market has historically struggled to rise above (resistance) or fall below (support).

- Entry: You can buy when price reaches a support level (which often indicates a higher bounce).

- Exit: Conversely, you can sell when price approaches resistance.

This strategy allows you to anticipate trend reversals and optimize your entry and exit points.

4. Using the RSI (Relative Strength Index)

The RSI is a momentum indicator that measures the speed and magnitude of price movements. It oscillates between 0 and 100 :

- RSI above 70: Signals a market in an overbought situation, which may announce an imminent correction (sell).

- RSI below 30: signals an oversold market, which may herald a recovery higher (buy).

The RSI is an excellent indicator for confirming potential reversals identified via moving averages or support/resistance.

The best trading platforms to start with

If you are new to the world of trading, choosing a platform that is reliable and easy to use is crucial. Here is a list of the 10 most popular trading platforms in 2024, ideal for beginners :

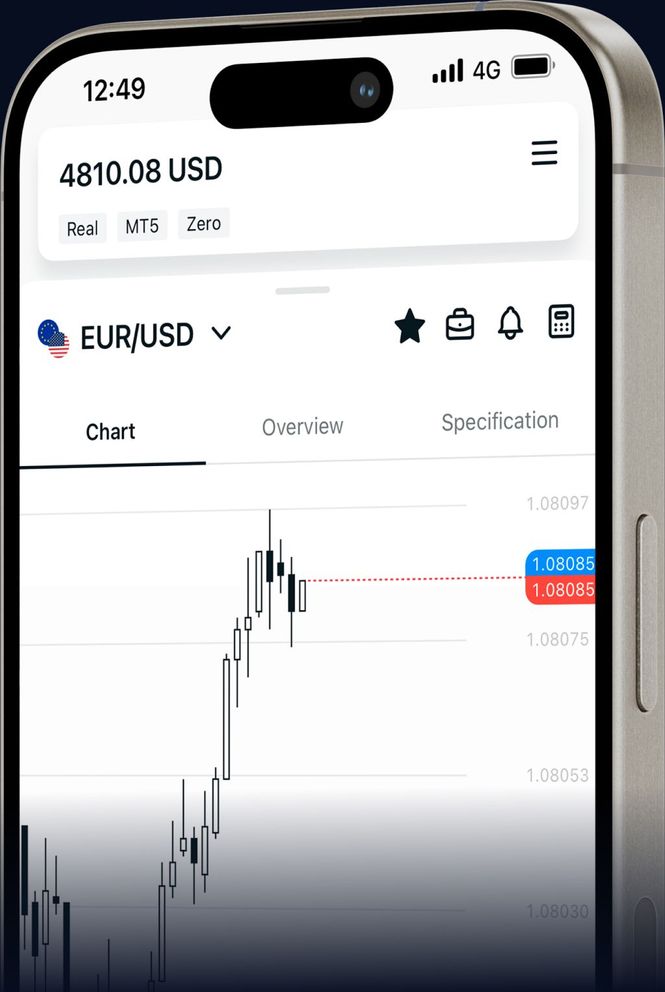

- XM Global – Is perfect for beginners thanks to its $30 welcome bonus which allows you to start trading risk-free. Additionally, a demo account is available to learn how to trade without the risk of losing money.

- Exness – Offers you a demo account to practice and test strategies in real conditions, without taking any financial risk. With competitive spreads and excellent order execution, it is an ideal platform for traders of all levels.

- MetaTrader 4 (MT4) – A classic platform, ideal for currency trading.

- eToro – Popular social trading platform, ideal for copying strategies from experienced traders.

- Binance – Ideal for cryptocurrencies with an intuitive interface.

- Interactive Brokers – Advanced options for experienced traders yet accessible to beginners.

- Plus500 – Known for its ease of use and wide range of financial instruments.

- IG Markets – One of the pioneers in the world of online trading, renowned for its reliability.

- Saxo Bank – Ideal for traders looking to invest in multiple markets.

- Coinbase – Perfect for cryptocurrency traders looking for a simple and secure interface.

Trading strategies: how to maximize your profits ?

In swing trading, patience is key. You have to know how to identify good opportunities and agree to let trades pass if the conditions are not met. Here are some tips to maximize your chances of success :

- Technical analysis: Use tools such as moving averages or Bollinger bands to determine ideal entry and exit points..

- Risk management: Set a stop-loss for each position to limit your potential losses. Never bet more than you are willing to lose.

- Trade Planning: Take time each weekend to review your positions and plan for upcoming trading opportunities..

Swing Trading FAQs

- 1. What is swing trading ?

Swing trading is a trading method that involves keeping a position open for several days or even weeks in order to take advantage of natural market fluctuations.

- 2. How much time should you spend in front of the screen trading ?

Unlike day trading, swing trading requires much less screen time. You can analyze the markets for a few hours a week and let your trades play out.

- 3. What is the best strategy to get started with swing trading ?

Strategies based on moving averages, supports/resistances and RSI are ideal for beginners because they are simple and make it easy to identify market trends.

- 4. How much money do you need to start swing trading?

Vous pouvez commencer avec un montant modeste, souvent entre 100 et 1000 €, selon la plateforme choisie et les instruments que vous tradez.

- 5. Quels sont les risques du swing trading ?

Comme tout type de trading, le swing trading comporte des risques, notamment les pertes dues à la volatilité du marché. Il est important de bien gérer votre capital et d’utiliser des stop-loss pour limiter les pertes.

Conclusion

Swing trading is a method accessible to everyone, whether you are a beginner or experienced. It offers a perfect balance between flexibility, risk management and earning potential. If you want to diversify your sources of income while maintaining a flexible schedule, this method is ideal for you. Make sure you choose the right trading platform, develop a well-thought-out strategy, and always manage your risks carefully.

I personally recommend XM Global for its ease of use, exceptional customer service, and $30 welcome bonus that lets you start trading risk-free. Additionally, XM Global offers a demo account to practice and learn how to trade without the risk of losing money. You can register ici to benefit from these advantages

For traders looking for low spreads and fast execution, Exness is a great option. Exness also offers a demo account, ideal for testing your strategies in real conditions without risking your capital. Rregister now and start trading with complete peace of mind

Also take advantage of the sponsorship program offered by XM Global and Exness to increase your income. By recommending these platforms to your friends or network, you can earn commissions for each validated registration. This is a great opportunity to generate additional income while helping others learn about trading.

The Ultimate Guide to Getting Started with Swing Trading in 2024